Investing for Beginners A Complete Guide to Start Smart

Investing for beginners can feel confusing at first. Many people want to grow their money but do not know where to start. The good news is that investing does not have to be complicated. With the right knowledge and a clear plan you can begin your journey with confidence. This guide will walk you through the basics of investing step by step.

You will learn what investing means, why it is important and how even small amounts of money can grow over time. By the end of this article you will understand the most common types of investments and how to build a simple strategy for yourself. This will help you take control of your money and work toward your financial goals.

Why Investing Matters

Investing for beginners often starts with the question Why should I invest? The main reason is that money loses value over time because of inflation. If your money just sits in a savings account it will not grow enough to keep up with rising costs. Investing allows your money to work for you so it grows while you sleep.

Another reason is building long term wealth. Most successful people grow their wealth through investments like stocks, bonds or real estate. This helps them not only save money but multiply it. Even if you start small, the power of compound growth can make a big difference over the years.

Investing also helps you prepare for the future. You may want to buy a home to fund your children’s education or save for retirement. Without investing, reaching these goals can be much harder. But with the right investments these dreams become more achievable.

Lastly, investing gives you financial freedom. When your money grows it reduces stress and gives you more choices in life. Instead of worrying about every expense you can enjoy your money while still building security for the future.

Setting financial goals

Before starting investing for beginners it is important to know your goals. Ask yourself, “What do I want to achieve with my money?” Some goals are short term like saving for a vacation. Others are long term like retirement. Each type of goal needs a different investment strategy.

When you set clear goals you can decide how much risk to take. For example if you need the money in two years it is safer to keep it in a low risk account. But if you are investing for retirement you can take more risk for higher growth.

Goals also give you motivation. When you know you are investing for your dream home or your future freedom it becomes easier to stay consistent. Many beginners quit investing because they do not see fast results. But if your goal is clear you will keep going even when progress feels slow.

Start by writing your goals on paper. Make them specific and realistic. Instead of saying I want more money, say I want to save ten thousand dollars in five years. This way you can track your progress and adjust your plan when needed.

Understanding risk

Investing for beginners is not only about growth, it is also about risk. Risk means the chance of losing money. Every investment has some level of risk but the key is to manage it wisely.

Low risk investments include savings accounts and government bonds. They are safe but give smaller returns. Medium risk investments include mutual funds and index funds which spread your money across many companies. High risk investments include individual stocks or cryptocurrencies which can rise or fall quickly.

Beginners often fear risk and avoid investing. But without risk there is no growth. The goal is not to remove risk completely but to balance it. A balanced portfolio mixes safe investments with some growth options.

The good news is that risk decreases with time. The longer you stay invested the more you can handle ups and downs. History shows that the stock market always grows in the long run even if it falls sometimes.

Understanding your own comfort level is important. If big changes make you nervous choose safer options. If you can handle ups and downs you can try higher growth options.

Types of investments

Stocks

Stocks are shares of a company. When you buy a stock you own part of that company. If the company grows your stock value increases. Stocks can bring high returns but they also come with high risk.

Bonds

Bonds are loans you give to governments or companies. In return they pay you interest. Bonds are safer than stocks but give lower returns. Many beginners use bonds for steady growth.

Mutual funds

Mutual funds combine money from many people to buy stocks and bonds. This reduces risk because your money is spread across many investments. They are a good option for beginners who do not want to pick individual stocks.

Real estate

Buying property can also be an investment. You can earn money from rent or from selling the property at a higher price. Real estate usually grows in value over time but it requires more money to start.

Index funds and ETFs

These are baskets of stocks that follow the market. They are low cost and safer than picking single stocks. Many experts suggest index funds as the best choice for beginners.

How much money you need to start

One common myth in investing for beginners is that you need a lot of money to start. In reality you can begin with very little. Some investment apps allow you to start with as little as ten dollars.

The important thing is not the amount but the habit. If you invest even small amounts regularly it adds up over time. This is called dollar cost averaging where you invest the same amount every month no matter the market condition.

For example if you invest one hundred dollars every month for ten years you could build a large amount with the power of compound growth. The earlier you start the better because time helps your money grow.

Also remember that investing should not affect your daily needs. Always pay your bills and keep an emergency fund before you invest. This way you can invest without stress.

So do not wait until you have thousands of dollars. Start small today and grow your investments step by step.

Common mistakes to avoid

Beginners often make mistakes when they start investing. One mistake is trying to get rich quickly. Investing is not gambling it is a long term plan. Quick profits are possible but they usually involve high risk.

Another mistake is not diversifying. If you put all your money in one stock or one type of investment you can lose it all if it fails. Spreading your money across different assets makes you safer.

Many beginners also panic when the market goes down. They sell too quickly and lock in their losses. The smart move is to stay patient because markets always recover over time.

Ignoring fees is another mistake. Some funds or platforms charge high fees that reduce your returns. Always check the cost before you invest.

Lastly, some people never start because they keep waiting for the perfect time. The truth is there is no perfect time. The best time to start is now.

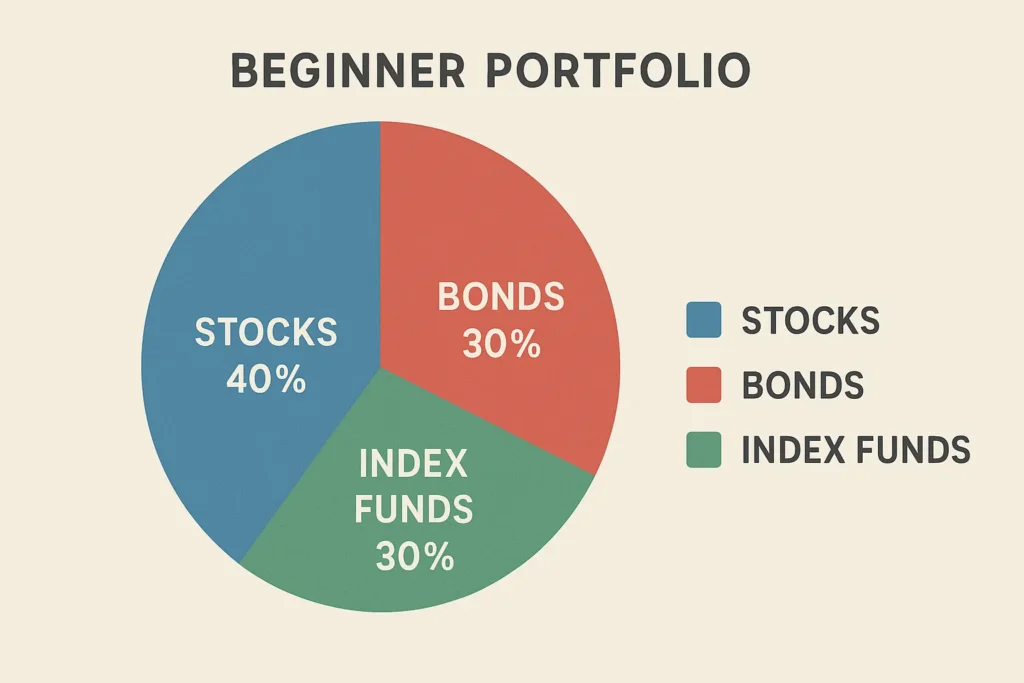

Building your first portfolio

A portfolio is a collection of your investments. For beginners the best portfolio is simple and balanced. You do not need to pick dozens of stocks. Instead choose a mix of index funds, bonds and maybe one or two growth stocks.

For example you can put 60 percent of your money in index funds, 30 percent in bonds and 10 percent in individual stocks. This gives you both growth and safety.

Keep your portfolio simple so it is easy to manage. Review it once or twice a year to see if it still matches your goals. Do not change it too often because long term growth needs patience.

As your income grows you can add more investments. The important thing is to stay consistent and disciplined. A small but steady portfolio grows into a strong one with time.

Learning and improving

Investing for beginners is a journey of learning. The more you read and practice the more confident you become. Start with simple books, blogs or podcasts about personal finance. Follow experts but do not copy blindly, always think for yourself.

Learning also means understanding your mistakes. If you make a bad investment do not quit. Instead note what went wrong and use it as a lesson. Every investor learns through mistakes.

Stay updated with financial news but do not let daily noise control your decisions. Focus on your long term goals instead of short term market moves.

Also try to talk with other investors or join communities. Sharing experiences helps you avoid mistakes and stay motivated.

The key is to keep growing your knowledge while keeping your strategy simple.

Conclusion

Investing for beginners does not have to be hard. It is about starting small, setting goals and learning step by step. You do not need to be rich or an expert to begin. With patience and consistency anyone can grow their money.

The most important thing is to take action. Waiting for the right moment only delays your future growth. Even a small start today is better than a big start later.

By understanding risk, choosing the right investments and avoiding common mistakes you can build a strong financial future. Remember investing is not about luck it is about discipline and time.

FAQs

Q1: How much money do I need to start investing?

You can start with a very small amount, even ₹500 or $10, depending on the platform. Consistency is more important than size.

Q2: Is investing safe for beginners?

Yes, if you use simple options like index funds or ETFs. No investment is risk-free, but spreading your money reduces risks.

Q3: What is the best first step in investing for beginners?

The best first step is to set clear financial goals and build a small safety cash fund before putting money in the market.

Q4: How long should I keep my money invested?

Ideally, keep it invested for at least 5–10 years. The longer you stay invested, the more your money grows with compounding.

Q5: Can I lose money as a beginner investor?

Yes, short-term losses are possible. But staying patient, diversifying, and not panicking helps reduce risks and grow wealth in the long run.